The global economic crisis, the post- covid market environment and regulatory framework modifications have all significantly affected the economy worldwide. Banks have been re-evaluating and altering their operational strategies and processes in accordance with their new business environment. Similarly, several banking systems in industrialized economies are dealing with low profitability and legacy issues. The transformation brought significant fintech evolution.

Digital Revolution & FinTech Evolution in Retail Banking

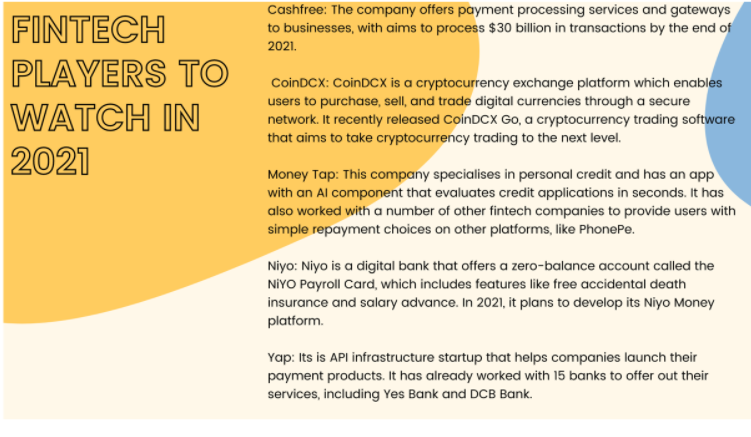

India’s fintech market is growing rapidly with 67 percent of the 2000+ fintech firms established in the last five years. As the country’s technology and financial capitals, Bengaluru, Mumbai, and Delhi are where most fintech firms locate their India headquarters. In the quarter of June 2020, 33 new fintech investment contracts worth US$647.5 million were finalized in India, compared to US$284.9 million in China. The fintech market in India is already worth US$31 billion and is anticipated to expand to US$84 billion by 2025. By 2023, the value of fintech transactions is expected to increase to US$138 billion, up from US$66 billion in 2019.

Key drivers for FinTech Evolution in Financial Sectors

- Start-up India: A government-led project to organize and strengthen India’s start-up ecosystem.

- Aadhaar: A Indian biometric identification card that can be used to verify digital payments by anyone living and working in India.

- Jan Dhan Aadhaar: A government proposal to link Jan Dhan accounts with Aadhaar and mobile numbers to deliver subsidies directly to those in need.

- India Stack: An ambitious software strategy that would employ application programming interfaces (APIs) to unite the government and start-ups under a single digital infrastructure to accomplish paperless and cashless financial service delivery.

- The blockchain market is expected to develop at a 37 percent compound annual growth rate (CAGR) until 2024.

A significant evolution in Banking Industry

The CGFS Working Group evaluates trends in bank business models, performance, and market structure in this research. They assesses their implications for banking market stability and efficiency. The following are the main results regarding the Fintech evolution of banking sectors:

-

Changes in the banking structure and capacity

In many industrialized nations, the crisis stopped a period of the rapid boom in banking sector assets. Various capacity measures show that banking sectors are declining in relation to economic activity in several crisis-affected nations. Rather than firms exiting the market, this adjustment has primarily occurred through a decline in business volumes. In countries less hit by the crisis, notably large emerging market economies, banking sectors have grown (EMEs). With a few exceptions, banking system concentration has tended to rise.

2. Consumer lending fintech leads the way as loans become increasingly mobile

The increasing number of consumers opting for loans through fintech lending apps demonstrates a compelling rationale for loans moving to mobile. Indeed, the predicted growth rate for fintech loans in 2020 was 9.1%, with the market expected to reach $291.4 billion (transaction value in 2021) and $396.8 billion by 2024. In Quarter 4, 2020, downloads of the top ‘buy now, pay later’ applications increased year over year (the holiday quarter). Low interest rates, less predatory policies than traditional credit card firms, and lending decisions made without regard to credit scores have contributed to the rapid adoption of digital installment plan apps among young customers. In January 2021, the number of daily active users of alternative financing applications increased by 36.3 percent. This is yet another sign of the vertical’s expansion.

3. Transformation in banks business models

Banking in advanced economies has shifted away from trade and more complicated operations. It started to move toward less capital-intensive businesses such as commercial banking. Changes in bank asset portfolios, revenue mix, and growing reliance on consumer deposit funding show this tendency. Significant European and American banks have also become more selective and concentrated in their international banking activities. In contrast, banks from large EMEs and nations less affected by the crisis have grown globally.

4. Investments

In the investment and trading sector, downloads, new users, and worldwide app sessions have increased steadily during the summer of 2020. Users of all generations spent more time in banking and trading applications, with Gen Z users spending over 127 percent additional time in-app to track investments. During the pandemic year, time spent in-app on no-commission trading applications like Robinhood climbed by 183 percent. Crypto-trading is one of the primary growth factors for the investing and trading vertical. The crypto-coin industry experienced a bull run after the Supreme Court of India relaxed the rules on cryptocurrency exchanges in March 2020. Several currencies seeing up to 80% increases in value, and global giants like PayPal, Tesla, JP Morgan, and Visa lending credibility to the industry.

5. Higher downloads for personal finance and banking apps

With consumers trapped at home due to lockdown and state-mandated curfews, the captive audience had plenty of time to peruse the offerings of various personal money management applications.

The number of downloads for the financial apps has exploded during much of 2020 and will continue to rise well into 2021.

Banking Customer Experience Trends in 2021 – Post-Covid FinTech Evolution

The covid-crisis accelerated natural progress several times over, resulting in a massive fintech evolution from physical to digital. People have begun to adopt new behaviors that are likely to become habitual. The mere fact that a financial institution is digitally developed is insufficient to secure its survival. To adapt to the post-pandemic society, excessive customer-centricity is becoming a requirement. The following digital banking user experience trends will assist you in determining the best strategy for the post-pandemic years of 2021 and beyond.

COVID-19 has amplified the importance of every digital banking trend for 2021. As a new generation of post-COVID clients emerges, the bar for digital banking user experience and digital transformation activities has been raised significantly. According to a McKinsey study, 75% of customers have tried other brands since the pandemic began. .60% of those customers plan to embrace new brands into their post-pandemic lifestyles and routines.

How can banks and financial institutions reclaim fintech customers following the pandemic?

The current coronavirus outbreak has highlighted the importance of financial institutions speeding up their digital banking reforms. However, the banking industry must adapt business strategies for front-facing and back-office operations to keep up with changing times and avoid potential future disruptions. Effective digital banking and a comprehensive transformation require cutting-edge technology such as blockchain, cloud computing, and IoT.

Customer Service

Small financing banks have a high-touch style. Customer relationship managers interact with customers in person and allow customers to contact call centers for information on loans, moratoriums, and other issues. The procedure was revised by Ujjivan Bank, among the most popular small financial institutions, by decentralizing contact centers and adopting cloud-based contact centers.

Expanding the digital horizons

Despite the clear necessity for highly optimized digital channels and excellent banking client experiences, the pandemic has exposed the financial industry’s catastrophically inadequate readiness to embrace the digital age. In an age where digital is everything, it seems irrational that people are still asked to risk their health to visit a bank branch.

Redefining the collection process

Digital collection from customers (with small-ticket loans) was nearly unheard of for a small financing bank. Partnerships with payment banks and players from around India. The complete collection system for Ujjivan Small Finance Bank was likely to be scaled up to 1.5 million touchpoints. Customers could make the payment and have it credited to their bank account by walking up to payment banks or BC stores. Ujjivan Bank saw a peak of 40% digital collections, which has subsequently stabilized at 15-20%, a great accomplishment that will result in even more cost reductions.

Internal process optimization

The aim was to develop an RPA (Robotic Approach Automation) roadmap, automate activities to eliminate human dependency and create a system-driven process that began with operations and extended to other bank departments.

Ujjivan Small Finance Bank collaborated with BBPS aggregator SETU. It enabled EMI repayments using digital wallets to overcome the traditional collection procedure’s limitations and engage clients in the digital ecosystem. The Small Finance Bank also formed alliances with key Indian cellular carriers to assist digital non-natives in repaying their EMIs by just walking into stores and depositing the EMI amount.

Many banks had previously begun to implement some or all of the following, but COVID-19 has highlighted the importance of these four areas in doing digital work for customers and banks.

- Redefining the customer experience: Putting customers’ requirements first to create long-lasting solutions. Throughout the lifecycle of a proposition, banks should consider co-creating with clients regularly.

- Take a mobile-first approach: Customers expect service and product accessibility via portable devices at any time, from contactless banking to account access.

- Creating a personalized data strategy: Creating solutions requires understanding what data you need, what queries you need to ask of that data, what data you have, and how to interpret the responses. The importance of centralizing current datasets cannot be overstated.

- Choosing the correct technological platforms: Choosing which platforms to use and how to use them is critical when incorporating new services into businesses with large legacy procedures and assets subject to high levels of regulatory scrutiny, such as banking.

Case Study: How top banks and financial services companies are responding to the changing environment

MoneyTap

MoneyTap recognized that developing a better understanding of the consumer required an insights-led engagement approach.

How does the firm respond to the change?

- The firm examined the consumers who had been onboarded and projected their preferred communication channels, content preferences and churn risk using advanced analytics.

- Successfully created client segments based on geographic area, content affinity, and preferred language, which added layers of personalization.

- By orchestrating data-driven user journeys, enhancing user reachability, and optimizing the success of engagement efforts with machine learning.

Some factors that helped them with the data-driven approach are:

ZestMoney

Since its inception, financial inclusion has been ZestMoney’s objective, as evidenced by the marketing phrase ‘EMI for all,’ and 35% of all clients served are new to credit, meaning they don’t have a credit score or haven’t used credit cards, and so on. While there are roughly 50-60 million people with credit cards, about 200-250 million people are creditworthy but don’t have access to credit.

How the firm respond to the change?

- ZestMoney started providing a new facility to transact and expanded the distribution of areas where consumers can transact more ubiquity to enhance adoption and engage more customers.

- Customers can use credit on ZestMoney’s UPI product to transact not just where ZestMoney is integrated but anywhere UPI mode is supported.

- Invests in a robust merchant acquisition engine that adds new shops daily, offering users more credit options.

- Investing in tools to enhance the user experience by doubling down on mobile app development and introducing more features and capabilities.

CoinDCX

CoinDCX improved the onboarding experience by filling in gaps and implementing an omnichannel engagement strategy that involved studying and understanding consumer behavior while engaging them across many channels. The team’s plan for the first step in their updated strategy was to examine their entire onboarding process.

How the firm respond to the change?

- The brand discovered the greatest touchpoints at which the user became inactive or dropped off using advanced analytics.

- They then looked at the user’s most recent active action, which helped them determine which touchpoints to focus on during the onboarding process.

- CoinDCX ran push alerts and email campaigns for active customers in addition to onboarding and reactivation campaigns.

- This technique for reading the pulse of consumers assisted them in identifying gaps in engagement and overall experience across the website and app.

- Actions to make dormant users active: CoinDCX customers are usually active after their first purchase and continue buying and selling bitcoin based on market conditions or personal preference. However, a few users remained inactive after a specific amount of time had passed. As a result, the brand’s next step in its engagement strategy was to react to these dormant users and encourage them to resume their activities.

The firm was able to make essential modifications to the user experience and engagement messaging due to the feedback. This directly influenced their weekly active user count, which has increased by 80% since January 2021.

Takeaway

The lockdowns brought about swift changes that no one could have predicted. The pandemic has taken a toll on the entire world. Nobody anticipated it to happen, but it did, with all the ramifications and repercussions that came with it. The world as we know it will never be the same again. This is the year when every company is reminded of why they exist and what they have to offer their customers. It’s all about figuring out the most acceptable ways to service the clients and alleviate their daily challenges in these situations. Customers will show their trust, loyalty, and respect for the financial brand if they perceive that it has their back, cares about them, and actively seeks new methods to help. This level of trust, loyalty, and respect would be impossible to achieve outside of the crisis. Hence, appICE as a FinTech Service Provider view it as an opportunity to help financial institutions with digitalization and form long-lasting emotional connections with the customers in the post-pandemic world.

No Comments