CDP (Customer Data Platform) does a lot more than just collecting user data, they give us the right kind of data with a 360-degree view of the customer. This article will demonstrate various CDP usecase that deliver customer engagement in terms of user experience in banking sector.

Who should read this?

- Banking Marketers

- Retention Marketers

- Campaign Managers

If you belong to any of these roles or aim to become any of these, it is your ultimate goal to generate more leads and revenue for your organization.

This article will help banking marketers to know the different CDP use cases and determine ways to implement for their respective companies.

CDP Usecase – Overview

In recent days marketers are highly eyeing on customer data platforms (CDPs) as a right solution for managing the disparate and myriad sources of data that companies collect and generate about their prospects and customers.

The requirement for such CDP platforms evolved as the volume of data continued to increase dramatically, leaving executives and marketers with a sense of surplus data and no proper and practical way to efficiently integrate these data points to make sure that their marketing and brand decisions are driven not only by a few data points. They ensure to include all available data in context for decision making

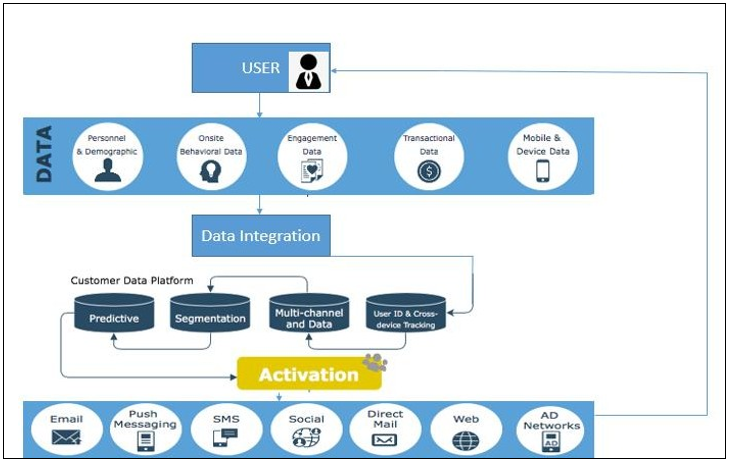

A BRIEF OF CDP (Customer Data Platform)

A CDP gathers and transforms data into actionable and clean information that can be successfully leveraged for a brand’s marketing strategy and the implementation of omni-channel marketing campaigns.

CDP (Customer Data Platform) contains actionable marketing data and the capability to create, run, implement and analyze marketing actions such as Segmentation, Analysis, Campaign Management, and Journey Orchestration.

WHY YOU SHOULD USE OF CDP

- It lets you generate reports across various channels with the support of CDP tools.

- The CDP platform enables you to have access to user data at various stages.

- You can have a full view of a user and so you can implement better targeting approaches.

- The CDP tools easily lets you segment the target audience based on the criteria

- Enable you to optimize the marketing campaign management process.

- Let’s you submit various compliance-related documents quickly as all the data is maintained in a single tool.

CORE ELEMENTS OF BANKING CDP Usecase

- Identity Management

- Data Governance & Regulations

- Integration and Connectivity

- B2B and B2C Banking Interface

- Data Insights

The below segment describes CDP Use Cases that marketers can implement for the Banking Industry

CDP USECASE 1 – PRODUCT INDENT

User visits the bank website to apply for a credit card and drops off with our prominent action. CDP helps the user to target the prominent users with a personalized credit card notification.

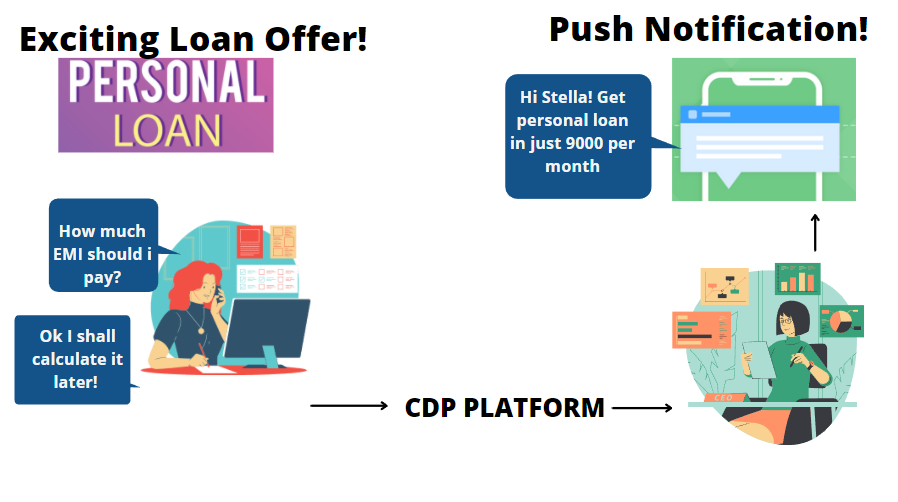

CDP USECASE 2 – Calculated EMI

User visits a bank website and tries to calculate his loan EMI amount and drops off without taking any prominent action. CDP helps the marketers to identify the relevant context for prospects and send personalized messages about EMI Calculation.

CDP USECASE 3 – PENDING DOCUMENT UPLOAD

A user drops off from a bank’s website without uploading essential documents for loan application. CDP helps to identify the relevant context for prospects and send personalized email asking them to upload the documents.

TAKEAWAY

The above-mentioned CDP use cases demonstrate how various banks across financial industries have transformed their marketing practices.

Below mentioned are the KPIs of their marketing transformation.

- Improved Audience Engagement

- Higher Sales Qualified Leads (SQL)

- Better Return on Investment (ROI)

- Better content personalization

- Improved online sales

No Comments