Marketers, who wanted to succeed in the competitive world, should have a complete understanding of the customer. Just focusing on the number of clicks or downloads will not be beneficial in the long run. They should adhere to the paradigm shift from increased Click-Through Rates to loyalty, retention, and building bonds between customers. Let us see about RFM analysis for Customer Segmentation.

The better approach to achieve good customer relationships is through the segmentation process.

Rather than spending time in analyzing the whole customer base and focusing only on age and geography, it is recommended to section them into homogeneous groups. This approach will let you better understand the traits of each group and better engage them with required or relevant information.

This is where the role of RFM analysis comes into the picture. Let’s have a deeper look at how this method is effective and let marketers determine customer behavior.

A brief on RFM Analysis

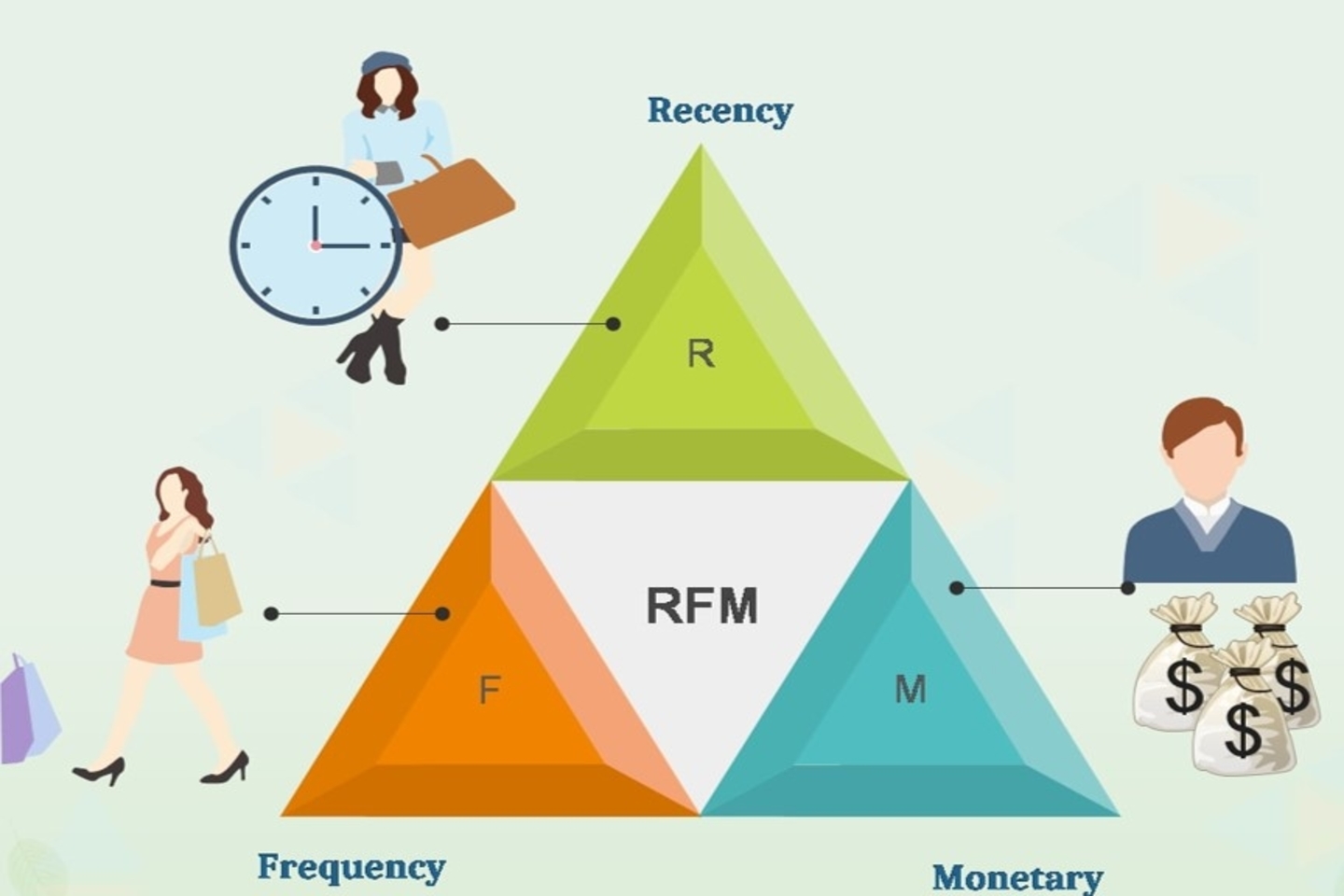

RFM (Recency, Frequency, and Monetary value) analysis is one of the easy to use, effective and popular methods to enable marketers to analyze consumer behavior. Each metric corresponds to other key consumer traits, as they are a significant indicator in determining consumer behavior. The metrics Frequency and Monetary value directly affect the customer’s lifetime value, while recency directly affects customer retention rates.

Recency: Measure the amount of time that had elapsed since a user’s last transaction or activity or with the brand

Frequency: Measure how often a user interacted or transacted or with the brand in a certain time frame.

Monetary: Measure the amount of money that a user has spent with the brand in a certain time frame.

If you are a brand that lacks monetary factors like a readership, viewership, can utilize RFE (Recency, Frequency, and Engagement value) analysis instead of monetary factors. Additionally, the Engagement metrics can also be defined as a composite value as per other metrics like visit duration, bounce rate, time spent per page, and a number of pages visited.

Benefits of RFM Analysis

Performing an RFM analysis on your user base and sending customized campaigns to high-value targets have huge benefits for your brand, especially if you are in the e-commerce business.

Personalization: By doing customer segmentation, you can create personalized and relevant offers that will engage your customers.

Improve Conversion Rates: Customized offers will eventually yield higher conversion rates as your users are engaging with services/ products they care about.

Increase profits and revenue

Improve unit economics

Furthermore, RFM analysis also gives us more insights into the facts described below:

– The more latest the buys, the more responsive the user is to offers and promotions

– The more often the user buys, the more satisfied and engaged and they are

– Monetary value helps in separating heavy purchasers from low-value purchasers

It has helped marketers to find answers to their most common questions like:

RFM analysis helps marketers find answers to the following questions:

– Who are your potential users?

– Which of your user segments could contribute to your churn rate?

– Which segment has the potential of valuable customers?

– Which of your users can be easily retained?

– Which of your users will respond to engagement campaigns?

Methods to implement RFM Analysis in Customer Segmentation

Let’s have a deeper look at how RFM works and how to implement it with a sample dataset of user transactions:

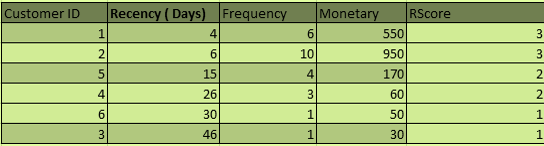

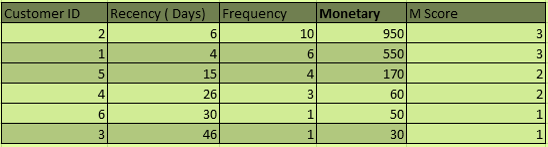

To execute RFM analysis for this sample data set, let’s explore how we can score these users by ranking them according to each RFM attribute separately.

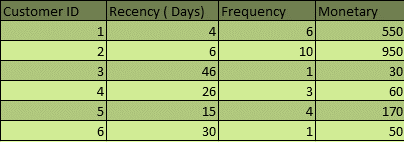

The below given are the sample data set of customers. Let’s consider that we rank the users from 1- 5 using RFM values:

As shown in the above table, we have sorted users by recency value. We had also assigned scores from 1-3 for the top 30% customers to receive a recency score of 3 (customer 1 and 2), the next 30% (the next 2users 5 and 4) receive a score of2, and the next 30% (customer 6 and 3) receive value 1.

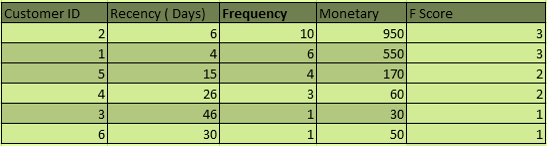

Similarly, we had sorted the sample data set for Frequency and Monetary Value.

Similarly, we had sorted users by frequency from high to low frequencies, assigning the top 30% a frequency score of 3.

When it comes to monetary factor, the top 30% of users are seen as big spenders, so they have been assigned a score of 3, and the lease spenders 30% users with a score of 1. These F Score and M scores are displayed below:

Analyzing RFM Segmentation

Let’s deep dive into segments of customers based on RFM analysis:

Champions: They are your popular clients, who purchased most to date, regularly, and are high spenders. Never fail to reward these clients. They can turn out to be early adopters for new service/ items and will help establish your image.

Potential customers: They are your esteemed clients with normal recurrence and who spent a decent sum. Offer loyalty programs or membership to trigger their interest. Keep suggesting related items to upsell them and assist them with turning into your Champion customers.

New Customers: They are your clients who have a high RFM score, but not regular buyers. Begin building associations with these clients by giving proper support and onboarding help to expand their purchases.

Customers likely to churn: They are your clients who bought frequently and spent large sums, however, haven’t spent much in recent times. Engage them by sending related information and customized campaigns to reconnect, and offer renewal or encourage another buy.

Takeaway

RFM is an information-driven client segmentation method that permits advertisers to make strategic choices. It engages marketers to rapidly distinguish and segment clients into homogeneous users and target them with customized and unique promoting strategies. Ultimately, this will improve customer engagement and retention rate.

No Comments