Financial services marketing refers to the deployment of various marketing strategies by marketers to acquire new customers or retain the existing ones. As a marketer, if you work in the financial services industry, you understand how challenging it is to stand apart.

What is a CDP?

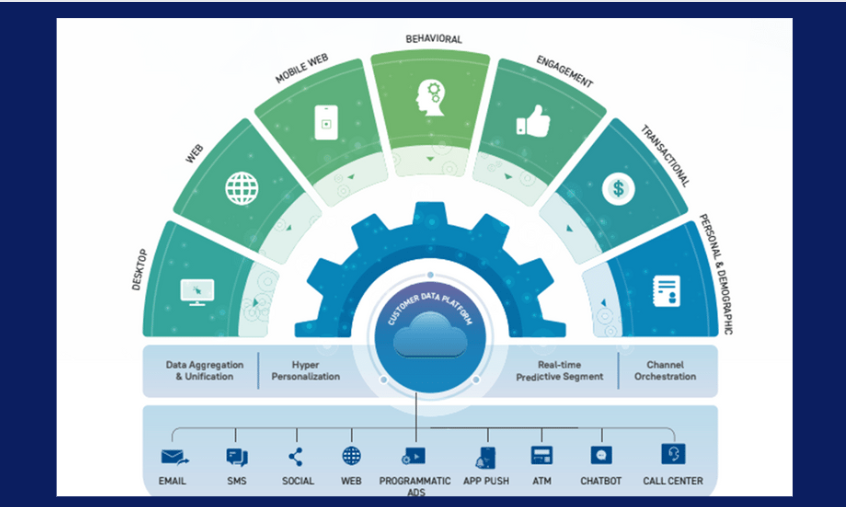

Customer Data Platform is a packaged software that creates a persistent, consistent customer database that is accessible to other systems.

Companies today have more data than ever before. There is everything from demographic data, transaction data, and product usage data to behavioral data, profile data and attitude data.

The majority of the time, data appears in silos, as the sources seems to be in multiple systems, teams, and channels. It’s tough to make sense of the statistics because of this. Acting on the data and creating a consistent consumer experience across all channels becomes even more difficult.

Companies have a big opportunity with data, but many of them don’t know how to collect it or use it for commercial purposes. The keys of client loyalty, commitment, and growth appear in customer data.

Benefits of vertical CDP

- Get a 360-degree perspective of your customers — A CDP is aggregation of data from many sources to produce a consistent consumer image. Hence, as a marketer, you will have a greater understanding of your target demographic and their behaviour.

- Increase transparency in your marketing activities – It can be tough to determine the true expenses and benefits of marketing campaigns. A CDP allows you to know exactly how much you’re spending and how well each channel and campaign is performing. Your digital marketing activities will be more transparent as a result of this.

- Gain insights that help you make better decisions — Gathering, evaluating, and acting on consumer data can help you make better, more fact-based decisions. Your organisation will be able to respond to market and client developments more quickly.

- Concentrate on business benefits – Many marketers and analysts today spend a significant amount of time collecting and analysing data. You’ll have more time to build profitability and a better client experience if you automate this and have it supplied in real-time.

- Improve the customer experience — Having a 360-degree customer view allows you to provide a unified customer experience. We utilise more channels and devices than ever before, and we want the same experience.

Vertical CDP (Customer Data Platform)

Poorly structured and disconnected data is not just a “Customer Experience” or “Activation” problem. t’s not simply a problem limited to digital marketing. Sure, the nature of the first data sets collected is marketing-oriented. This is very understandable. When high-volume, behavioural data from mobile and web assets combine with data from a wide range of sources, remarkable targeted benefits result.

As a result, cross-device analytics and experience/orchestration activation have risen to the top of the CDP use cases list.

However, digital marketing isn’t the sole application for structured data.

Let’s look at banks as an example. There is a slew of other advantages to structuring bank data sources:

Product teams start getting high-quality real-time data as they design new products or create up-sell/cross-sell offerings

Data governance across the organization becomes centralized and simplified

Analytics teams can start developing a nuanced, long-term understanding of users and start offering products to a user that they may otherwise drop or ignore

Benefits of Vertical CDP (Customer Data Platform)

Data models

A financial CDP delivers a detailed data model that contains financial services entities, attributes, and relationships. This saves substantial deployment time and can incorporate best practices that seem to be a unique concept for new CDP users. Segmentation, predictive modelling, personalization, reporting, and other system features let us take advantage of the data model, enabling these to also be more closely tailored to financial services needs.

Core system integration

A financial CDP will have prebuilt connectors to common core systems. These will still require configuration but that takes one to two months, compared with three to six months to build and test a custom connector. The prebuilt connectors are also able to take advantage of specific data models and capabilities within each core system, enabling more powerful interactions with the vertical CDP.

Analytics and campaigns

A financial CDP delivers libraries of standard analytics, reports, and campaign designs. These will draw on the standard data model, incorporate standard predictive models, and cover common challenges such as cross-sales and churn reduction. Without prebuilt libraries, each of these items could take weeks to months to develop, sharply limiting the number of programs that deploy quickly after the CDP is in place.

Security certifications

The key objective of the financial CDP is to meet industry security standards and will have already achieved the required certifications. The vendor will also have prepared other materials that are commonly requested by clients’ IT and security teams. This can save months off the time spent on internal reviews and approvals, as well as increasing confidence of all parties in the system.

How financial services businesses can harness the power of a Vertical CDP

Capture:

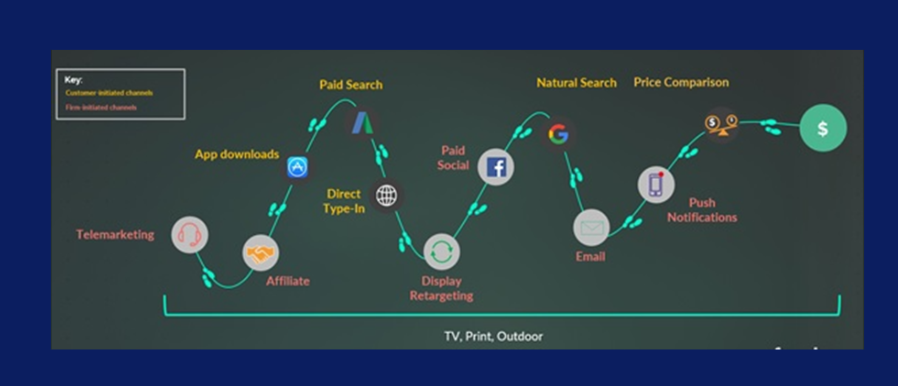

Every connection with a consumer generates a data point that provides a vital story about their journey to buy. However, with so many potential touchpoints, some organisations find it difficult to collect all of this information. Businesses must ensure that they are witnessing the entire path, from form interactions on your website to in-branch meetings, or brand exposure from an affiliate to engagement with an email campaign. Customer Data Platforms, which employ cutting-edge technology to collect and track data from all accessible sources, devices, channels, and sessions – both online and offline – are critical to streamlining this process and ensure to track customer experience at each stage

Integrate:

Even if you are effectively documenting client interactions, most firms keep this important data in discrete data silos, which means different channels and devices are treated as independent entities rather than interconnected ones. What’s the end result? Businesses that make channel decisions without considering the impact on other channels. A Customer Data Platform can combine and unify various data points, breaking down these lethal data silos to produce a holistic image of the customer, just as it can capture each data point.

Identify your customers:

Capture and integrate your diverse data sources is the first step in financial services organisations getting control of their data. However, integrated data is useless unless you know who it belongs to. The next step for firms that want to completely understand their customers is to connect their numerous data sources and link generally anonymized data (such as which affiliate website was utilised to visit your website) to known identifiers like an email address. Multiple visits – across multiple channels, sessions, and devices – are linked to one person in this way, allowing financial services marketers to gain a better understanding of who specific customers are, where they came from, what they view, and how they interact with your channels on their way to purchase.

Understanding your costs:

Businesses must strive to obtain an idea of what each of these channels costs – and which ones bring in revenue – now that they have this insight of how clients move across marketing channels. They will remain ignorant to what actually counts in a business: spending and return on investment if they do not do so.

Takeaway

Customer data is critical for decision-making and is becoming increasingly vital in marketers’ capacity to enhance their marketing efforts. Financial services businesses will remain blind to who their customers are and how they interact with their marketing channels on their path to conversion unless this information is captured, stored, and integrated effectively. Without this information, they will be unable to lay the groundwork for more optimised omni-channel experiences. In our upcoming article, we’ll look at how financial services companies can leverage this granular, single customer perspective to do proper attribution by attributing the cost and value of each of these marketing touchpoints, lowering the cost of client acquisition and retention.

No Comments