Due to the recent growth in mobile and cloud technologies, banking customers have embraced the concept of on-demand finance. People prefer to manage their money and businesses online. However, they are less prepared to put up with the slow pace and complexity of traditional services and fintech innovation. Overall, the financial technology sector is booming. With more conventional financial institutions boosting their fintech investments and contending with startups to provide faster and more efficient financial services.

Financial services are primed for dramatic change, with mega-corporations and startups alike pouring money into fintech ventures. It is anticipated that startups could acquire up to $4.7 trillion (approximately) in annual revenue. Among them over $470 billion in profit from traditional financial services organizations. They are taking advantage of fintech’s agility and flexibility to develop new financial products that help individuals effectively manage their money in novel methods. While implementing new financial technology entails risk, enterprise CEOs can find a plethora of ways to turn risk into profit.

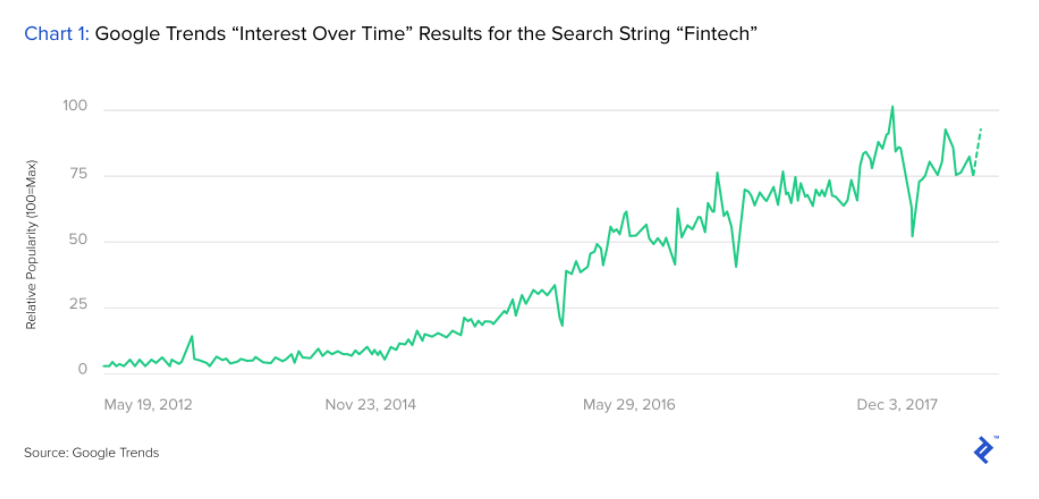

Fintech is regarded as a recent phenomenon. However the utilization of technology to help financial services is far from new. Financial services is a sector that pioneered credit cards in the 1950s, and digital banking services in the 1990s. Fintech’s public profile, on the other hand, has exploded in the last three years.

So far, most of the innovation in these specialized solutions has been generated on the front end, mostly by improving customer-facing aspects of financial services.

Here are some examples of how it is implemented:

- Better service: A typical bank binds a consumer in by providing them a variety of services that keep them loyal by increasing switching costs. Without this luxury, specialist fintech firms rely on better customer service and referral-based customer acquisition to acquire confidence. Improved customer experience is cited by 90% of fintech organizations as a critical competitive advantage.

- Better branding: The fintech industry is renewing the branding of the legacy services it is trying to upend, with personnel from non-traditional banking backgrounds contributing an unbiased perspective. Consumers find basic tasks like budgeting more appealing because to modern marketing methods like gamification.

- Cost-effectiveness: Fintech firms can attract clients with cheaper pricing because they have a smaller virtual operation. They also have better flexibility because they are not regulated like a deposit-taking institution, and funding from venture capital.

Latest Trends of Fintech Innovation

FinTech

FinTech Innovation In recent years, FinTech’s technological developments have been at the forefront of new technology disruptions. There were over 30 FinTech Unicorns worldwide by the end of 2017. This includes European startups like Klarna, Adyen, and Transferwise. It’s no surprise that traditional banks are looking to engage with FinTech companies to revamp their business models. Over €22 billion has been invested in FinTech globally in 2016. We discovered innovations that would cause substantial disruptions in the finance industry in the coming years through a large-scale review of 14.000 FinTech businesses.

Mobile Banking

Mobile Banking Mobile banking has come a long way, from SMS banking in 1999 to today’s smartphone banking apps. These transformation enable mobile payment and control of all financial services and banking institutions while on the go. Mobile banking not only reduces financial service location dependency and operational expenses. Their role is enormous in offering an end-user interface for the development of Banking-as-a-Platform (BaaP).

Blockchain

The majority of individuals were first acquainted to the blockchain during the cryptocurrency craze of the last two years. Blockchain provides a visible, secure, immutable, and trustworthy ledger to record contracts, and transactions. Additionally fintech innovation employs methods for cryptocurrency for private and rapid online transactions. Inter-bank and Intra-bank transactions have already been made cheaper and faster thanks to innovations like blockchain clearing, Blockchain Bonds, and settlement systems.

Big Data

New data sources, like mobile banking and the Internet of Things (IoT), give an extra layer of data collecting in addition to standard financial data collection. Big Data analytics, in conjunction with Artificial Intelligence, makes use of enormous amounts of old and new data to uncover underlying knowledge for fraud detection and better risk management. Big data provides new insights into client behaviour, allowing banks to produce better and more personalised goods and services.

Artificial Intelligence

Artificial Intelligence (AI) assists banks in analyzing their Big Data in order to improve current solutions and make more informed decisions. A more recent AI concept is to use cognitive capabilities to sift through enormous amounts of unstructured text and data in order to develop new insights and learn natural language. A more intelligent AI chatbot or virtual assistant might take over mundane “low-value” tasks. Some of them include processing small transactions, explaining financial products, and giving customers basic financial advice.

Takeaway

FinTech innovation have already generated numerous changes and disruptions in the finance industry. Mobile banking, mobile payment, and biometrics have all revolutionized the way many users communicate with their banks and financial institutions on a daily basis. In recent years, blockchain and cryptocurrencies have become well-known, but their true disruptive potential in the financial sector has yet to be realised.

Other FinTechs that are less well-known, such as Big Data, RegTech, and AI, will fundamentally alter the banking business paradigm. In order to react to the next wave of disruption, traditional banks must respond quickly. We at AppICE provide thorough research and actionable innovation information that enables our Banking Clients to collaborate with technology in order to stay ahead of the competition.

No Comments